All About Excess Liability - Favor & Company

COMMERCIAL UMBRELLA/EXCESS LIABILITY INSURANCE

Umbrella Insurance - Franklin TN - (615) 538-0900 - McKinney-Green Insurance

The Main Principles Of Excess liability Insurance - Aon

their properties to come up with the cash to

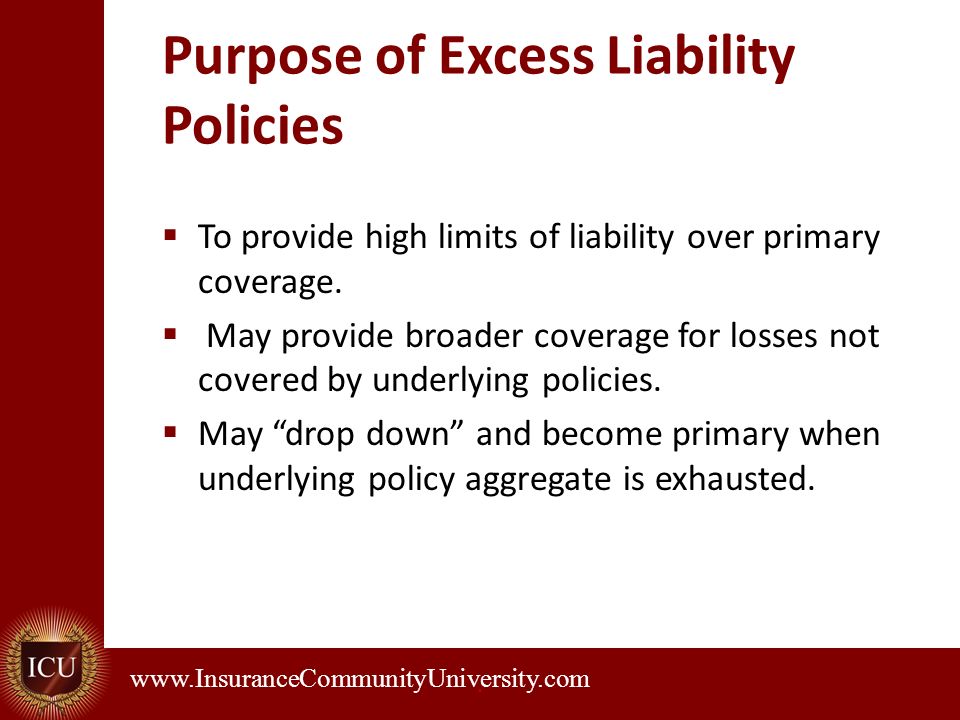

spend for the judgement. What is Excess Liability Insurance? An excess insurance coverage might likewise be described as excess liability insurance coverage. It is a kind of insurance protection that uses limitations which offer more protection than the underlying liability policy that a person already has. It assists by providing higher limits on top of the initial liability policy that the guaranteed person has. Simply put, an excess liability insurance plan is like taking out an insurance plan for your insurance. It helps to ensure that whatever is covered even if the insured's main insurance plan has actually reached its limits. Keep in Another Point of View :. So, if the insured has several insurance plan through one business, and has excess liability on their automobile insurance, it is not going to rollover for their house owner's insurance coverage. Excess liability insurance coverage is an additional kind of coverage, and it is not something that every person requires. If you don't have lots of assets or do not have a great deal of residential or commercial property to protect, you might not require to take out this additional protection. On the other hand, if you have a lot to lose and might potentially deal with a lawsuit, securing an excess insurance coverage can be advantageous. What is an Umbrella Insurance Plan? Umbrella insurance is a kind of policy that offers additional liability coverage over and above your current insurance plan. It is a choice that follows an auto insurance coverage, but is completely developed to add other policies to it, such as a property owner, watercraft, ATV, a RV policy and numerous more. Some insurance coverage service providers will suggest you get an umbrella policy if the policyholder's net worth is over $1 million. This is also the minimum liability quantity on one of these policies. Umbrella insurance is thought about

an excellent choice for anybody with possessions that are worth more than what they have in liability coverage for their home or car insurance coverage policies. Both umbrella and excess insurance coverage policies are developed to use protection above the limits of any underlying coverage. Nevertheless, the main difference between the two is that umbrella insurance coverage can expand your protection, or in.